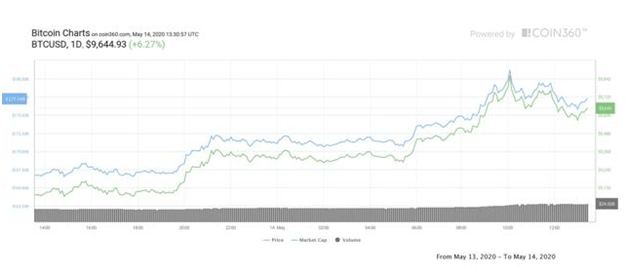

After halving, prices seem to stabilize below $ 8,700. Even the weekend before the halving, the Bitcoin price collapsed by 15% and ended up at $ 8,100. Since then, there have been problems leaving the $ 9,000 mark behind.

Within a few days after the halving, the price of Bitcoin collapsed by 15%. At $8,700, he seemed comfortable afterwards.

Phone the gloomy economic outlook according to US Federal Reserve Chairman Jerome Powell, Bitcoin touched several important resistance levels at once and ended up at a price of 10,000 US dollars. It seemed that Powell wanted to brought into play by the US Democrats Support the proposal of a $3 trillion stimulus. However, the FED chairman also announced plans for a negative interest rate, as before US President Trump on his favorite medium Twitter it was put up for discussion on Wednesday of this week.

Nevertheless, the BTC bulls took the helm and overshadowed the movements in the important S&P 500 index with a short-term trend.

Small Bitcoin Rally Closes the Biggest CME Gap

In anticipation of a new Bitcoin high in May, the bulls compensated for some losses over the past weekend. Because in intraday trading, the price climbed by 13%. On Wednesday of this week, the price of Bitcoin increased by 5,78 %, which corresponded to a price increase of more than $ 516. The price of the crypto reference currency started at just over $ 8,700. He closed around the psychologically important mark and hurdle of $9,200.

The trend continued on Thursday before a small correction, at the time of writing the price landed again at just over $ 9,700.

The temporary price rally to $ 10,000 shows that the market is leaving its recent slump behind. He closes the historic $ 1,200 gap in trading on the Chicago Mercantile Exchange (CME) in the field of Bitcoin futures – and within a few hours.

As mentioned last week, the probability of reaching the threshold of $ 10,000 was 77%. The cut in profits in trade in Europe does not stand in the way of optimistic forecasts. The fact that the price was able to close above the relevant level speaks in favor of “recapturing” the threshold of $ 10,000.

Technical analyst Michaël van de Poppe stipulate today’s uptrend as a sign of the return of Bitcoin “into a bull market” . In his opinion, there was the last slump before the halving, the decline by $ 400 in intraday trading represents a “nice trading range” for him on Thursday today.

As realistic lows, the analyst sees Bitcoin prices in the range between $ 8,250, $ 8,400 and $ 8,600. In doing so, he emphasizes a potential in the direction of highs between $ 9,800 and $ 10,100 for trading.

The gains of Bitcoin on Thursday Michaël van de Poppe by the positive price trend of gold (GLD) in the context of the economic outlook addressed by Powell. The precious metal recorded a price increase to over 1,700 USD during the writing of this article, the increase within 24 hours was 0.4%. Loud jmbullion.com, the gold price per troy ounce rose by $ 6.28 to $ 1,727.

The market of altcoins is also hopeful with an uptrend: the plus for Ethereum (ETH) was over 4%, the coin was traded at more than 205 USD. Ripple’s XRP rose to over $0.203 at press time, up 2.05%. Again, this is due to the crypto bulls and their hope for rising prices. For their part, BCH and BSV are in the green alongside EOS and LTC. BCH and BSV showed a significant increase in hashrates after BTC halving.

Comments