- XDC Network token price surged above $0.10 after the Binance.US listing news.

- The token’s price has since dipped, but it still holds strong above key support at $0.085.

- Fundamentals like LayerZero and ETP launch fuel the uptrend.

The XDC Network has been gaining traction in recent weeks, and its latest listing on Binance.US has only amplified the growing market interest.

After months of steady progress, the blockchain project is now in the spotlight following a sharp price movement and renewed investor confidence.

Binance US listing sends XDC price soaring

On July 30, Binance.US officially opened trading for the XDC/USDT pair, following a brief deposit window that allowed users to prepare their accounts in advance.

The announcement, which was made on July 29, pushed XDC prices sharply higher, with the token rallying more than 11% within 24 hours. It climbed from around $0.08985 to briefly break above the key $0.10 resistance, peaking near $0.10167.

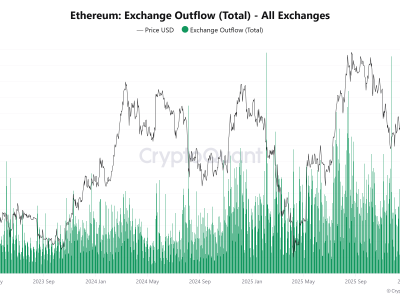

This move was not just about speculative hype. The breakout was supported by consistent trading volume and a steady formation of higher lows, indicating that buyers were stepping in rather than exiting the market.

The surge through the psychological $0.10 level signalled a return of bullish sentiment, which could set the stage for further gains if momentum continues to build.

Healthy pullback hints at a strategic entry

Despite the initial rally, XDC experienced a modest retracement after touching the $0.10 mark.

However, the dip has been largely viewed as a healthy correction within a broader uptrend.

Importantly, the token remains well above its 20-day exponential moving average, which has consistently acted as dynamic support during the recent rally.

The price is now hovering around the $0.098 mark, with the $0.085–$0.088 region emerging as a critical support zone. This area coincides with former resistance and trendline support, making it a strong demand level.

Should buyers defend this zone, the token could make another attempt at breaking above its recent high, potentially targeting $0.105 or even $0.115 in the near term.

Strong fundamentals are driving the uptrend

The recent price movements are not happening in isolation.

Several strong fundamental factors have been reinforcing XDC’s upward momentum. Chief among them is its successful integration with LayerZero, which went live on July 9.

This cross-chain upgrade has enabled seamless and zero-slippage transfers between XDC and major networks like Ethereum and Solana. This has significantly boosted XDC’s utility and interoperability, making it more attractive to both developers and long-term investors.

Additionally, institutional interest in XDC is growing. The launch of the 21Shares XDC ETP on Euronext Amsterdam and Paris earlier this month marked a major milestone in XDC’s journey toward mainstream adoption.

On top of that, its partnership with Archax — a regulated digital securities exchange — has positioned XDC well for compliance under the EU’s Markets in Crypto-Assets (MiCA) framework, signalling an alignment with regulatory expectations.

What traders should watch for next

With the Binance.US listing now live, traders are closely watching how the market reacts in the days following the event.

While early price spikes are common during major listings, sustained growth depends on volume retention and broader market sentiment.

XDC’s ability to maintain support above the $0.085 zone could be crucial in determining its short-term direction.

If buyers continue to defend this level, and if broader crypto markets remain stable, XDC could soon challenge its next resistance levels at $0.11 and $0.12.

However, a failure to hold key support could open the door for a retest of the $0.080 area, which may unsettle short-term bulls.

For now, the current dip could be a potential buy-the-dip opportunity within a strong uptrend.

The post XDC Network price forecast amid Binance US listing news appeared first on CoinJournal.

Comments