- US spot Ethereum exchange-traded funds (ETFs) attracted $523.9 million in net inflows on Tuesday.

- BlackRock’s ETHA led with $318.67 million in net inflows, followed by Fidelity’s FETH at $144.9 million.

- Ether has also seen significant price appreciation, rising 8.5% in the past 24 hours to trade at $4,667.

US spot Ethereum exchange-traded funds (ETFs) attracted $523.9 million in net inflows on Tuesday, according to data from SoSoValue.

The flows came a day after the funds recorded their largest single-day net inflow to date at $1.02 billion.

Six of the nine ether ETFs posted positive flows for the session.

BlackRock’s ETHA led with $318.67 million in net inflows, followed by Fidelity’s FETH at $144.9 million. Grayscale’s Mini Ether Trust reported $44.25 million in net inflows for the day.

This marks the sixth consecutive day of positive flows for ether ETFs, bringing total inflows over the period to $2.33 billion.

Collectively, spot ETH ETFs now hold $27.6 billion in net assets, representing about 4.8% of Ethereum’s total market capitalization.

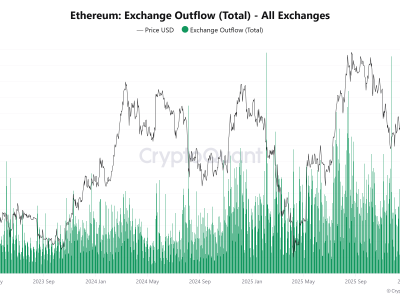

Shift from Bitcoin to Ether products

Nate Geraci, president of NovaDius Wealth, said the recent momentum in Ether ETFs reflects a shift from Bitcoin ETFs, which dominated inflows last year and earlier in 2025.

On Tuesday, spot Bitcoin ETFs recorded net inflows of $65.9 million.

Another half bil into spot eth ETFs…

5th best day since launch.

Now $2.3bil over past 5 trading days.

Since beginning of July, spot eth ETFs have taken in nearly $1.5bil more than spot btc ETFs.

Notable shift.

— Nate Geraci (@NateGeraci) August 13, 2025

Geraci said Ether ETFs may have been underestimated by traditional finance investors who previously did not fully understand Ethereum’s role.

He noted that the narrative around Ethereum as a potential backbone of future financial markets appears to be resonating with investors.

Ethereum price outlook

Ether has also seen significant price appreciation, rising 8.5% in the past 24 hours to trade at $4,667, nearing its record high of $4,878.26 set in November 2021.

Market participants are assessing the potential for further gains.

Crypto trader Yashasedu said historical trends show Ether tends to reach 30% to 35% of Bitcoin’s market capitalisation during major bull runs.

In 2021, Ether reached 36% of Bitcoin’s market cap.

If Bitcoin reaches $150,000, a 25% increase from its current price of $119,335, Yashasedu estimated Ether could climb to $8,656 if it reaches 35% of Bitcoin’s market capitalisation.

At the lower end of projections, Ether could trade between $5,376 and $7,420 based on a 21.7% to 30% market cap ratio.

Several industry figures expect Bitcoin to surpass $150,000 by year-end.

Fundstrat co-founder Tom Lee, BitMEX co-founder Arthur Hayes, and Unchained market research director Joe Burnett have all forecast that Bitcoin could rise as high as $250,000 by the end of 2025.

The post US spot Ethereum ETFs record $523.9M in inflows appeared first on CoinJournal.

Comments