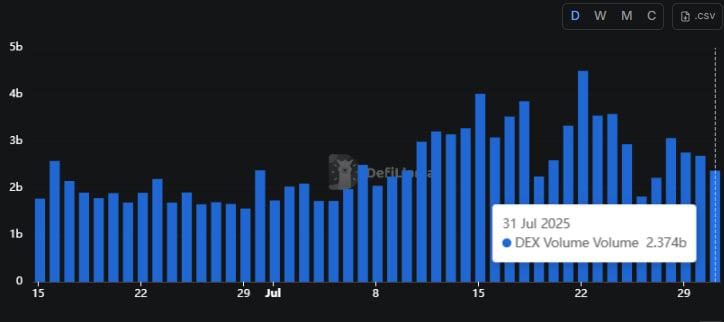

- Solana’s DEX volume has lost nearly $700 million since Monday.

- The downside follows comments from its co-founder criticizing meme tokens and NFTs.

- The remarks sparked debates, especially since meme cryptos have fueled Solana’s growth.

The latest comments from Solana’s co-founder, Anatoly Yakovenko, left speculative trading enthusiasts shaken.

Meanwhile, the blockchain reflects the impact on the decentralized exchange (DEX) front.

Yakovenko dismissed NFTs and meme coins as assets without intrinsic value in a July 27 X post.

He compared them to a mobile game loot box, which serves speculative individuals.

Meanwhile, the comments dented sentiments as Solana’s DEX volume has seen a 220% decline from Monday’s $3.071 billion to $2.374 billion today.

While sudden dips are not uncommon in the cryptocurrency industry, some participants are connecting the dots.

Meme cryptos have fueled Solana’s growth

It is the irony that grabbed the community’s attention. While meme tokens lack traditional utility, they have been vital in Solana’s latest boom.

Nearly all themed cryptocurrencies that have dominated trends in the past few years launched on the SOL blockchain.

PNUT, WIF, FARTCOIN, and the current PENGU, you can name them.

Furthermore, Solana boasts the largest meme launchpads (Pump.fun and Raydium).

At times when top chains like Ethereum and Cardano were quiet, Solana flourished due to viral meme assets and NFTs.

Moreover, leading Solana DEXs like Jupiter thrived during meme coin seasons.

With these trends, Solana attained a strong community, culture, profits, and growth momentum.

Thus, many equate Yakovenko’s comments to biting the hand that fed their ecosystem.

Solana-based exchanges have experienced substantial slowdowns days following the controversial comments.

Whether the 20% slide is a usual cool-off or a reaction to Yakovenko’s remarks, Solana’s ecosystem took a hit.

The tone might have discouraged some participants, who are likely considering alternative meme launchpads.

For digital assets enthusiasts, meme tokens and NFTs represent culture, accessibility, and creativity in the crypto industry.

Moreover, they lower entry barriers into Web3.

Meme tokens lack value, but drive excitement

Yakovenko’s comments weren’t unfounded. Most meme tokens lack utility beyond attention.

They face criticism since they lack legitimate backing, use cases, and the fact that most creators launch them as speculative plays.

Projects can record staggering surges overnight and crash within minutes.

You probably remember the controversial LIBRA case.

Libra surged to $224 million market capitalization project before crashing within hours, leaving its investors with massive losses.

Its current market cap is $3.94 million.

Hype, not fundamentals, dictates the life cycles of most meme coins.

However, they also work. While themed cryptocurrencies lack substance, they attract attention and excitement in the digital currency markets.

Also, they onboard retailers who want to join the market without navigating complex protocols.

This phenomenon has benefited Solana, putting it in the spotlight during periods when top blockchains felt dormant.

Though Yakovenko’s remarks appear true, they exposed the fragility between market behavior and logic in crypto.

Besides decentralization, the fun side of the blockchain industry remains vital for the sector’s liveliness.

The post Solana DEX volume dips 20% after co-founder slams meme coins appeared first on CoinJournal.

Comments