-

In the first four months of the year, a total of $ 37 billion was transferred to NFT marketplaces, compared to $ 41 billion in the whole of 2021

-

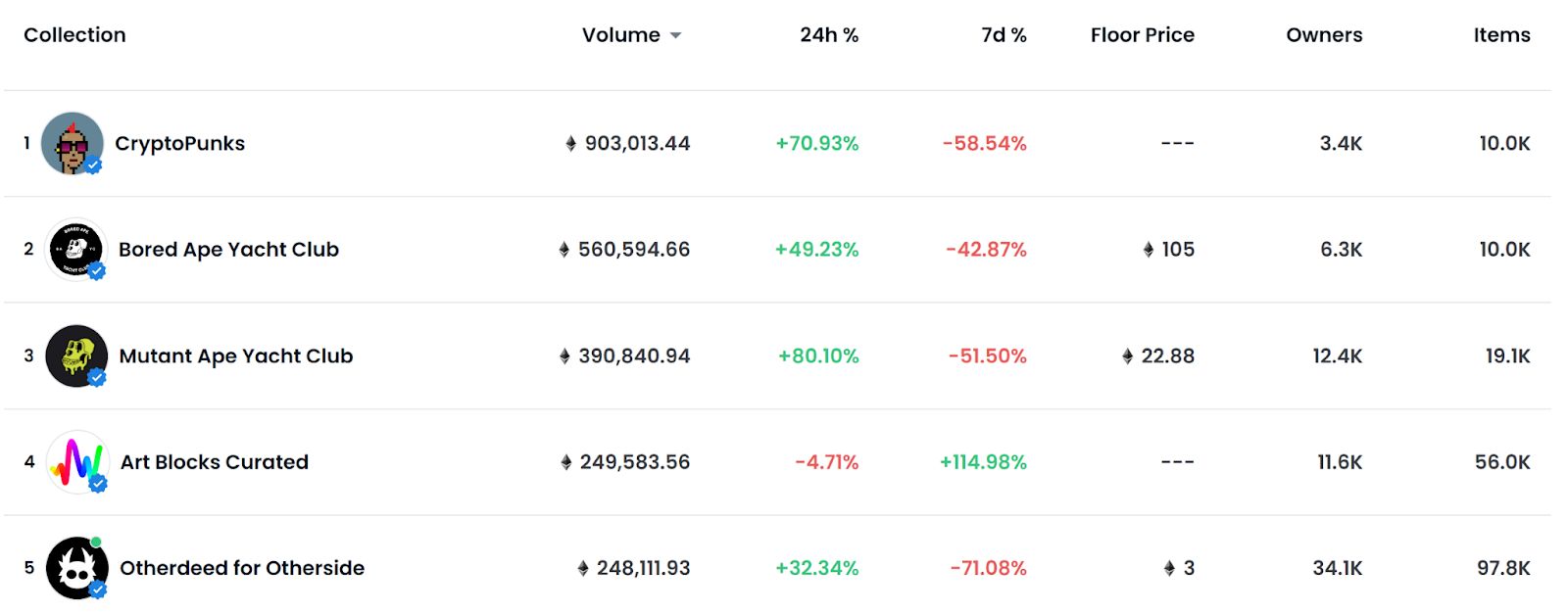

Yuga Labs, the creator of the Bored Ape Yacht Club, is the leader with three of the five largest projects by volume

-

The Otherside project in April is already the fifth largest project in history in terms of volume

-

NFTs are on track for a volume of 111 billion USD this year

While the cryptocurrency market is shaken by this week’s bloodbath (I’m looking at you, Terra), BitcoinMag thought it wise to take a step back and assess how far the market has come so far.

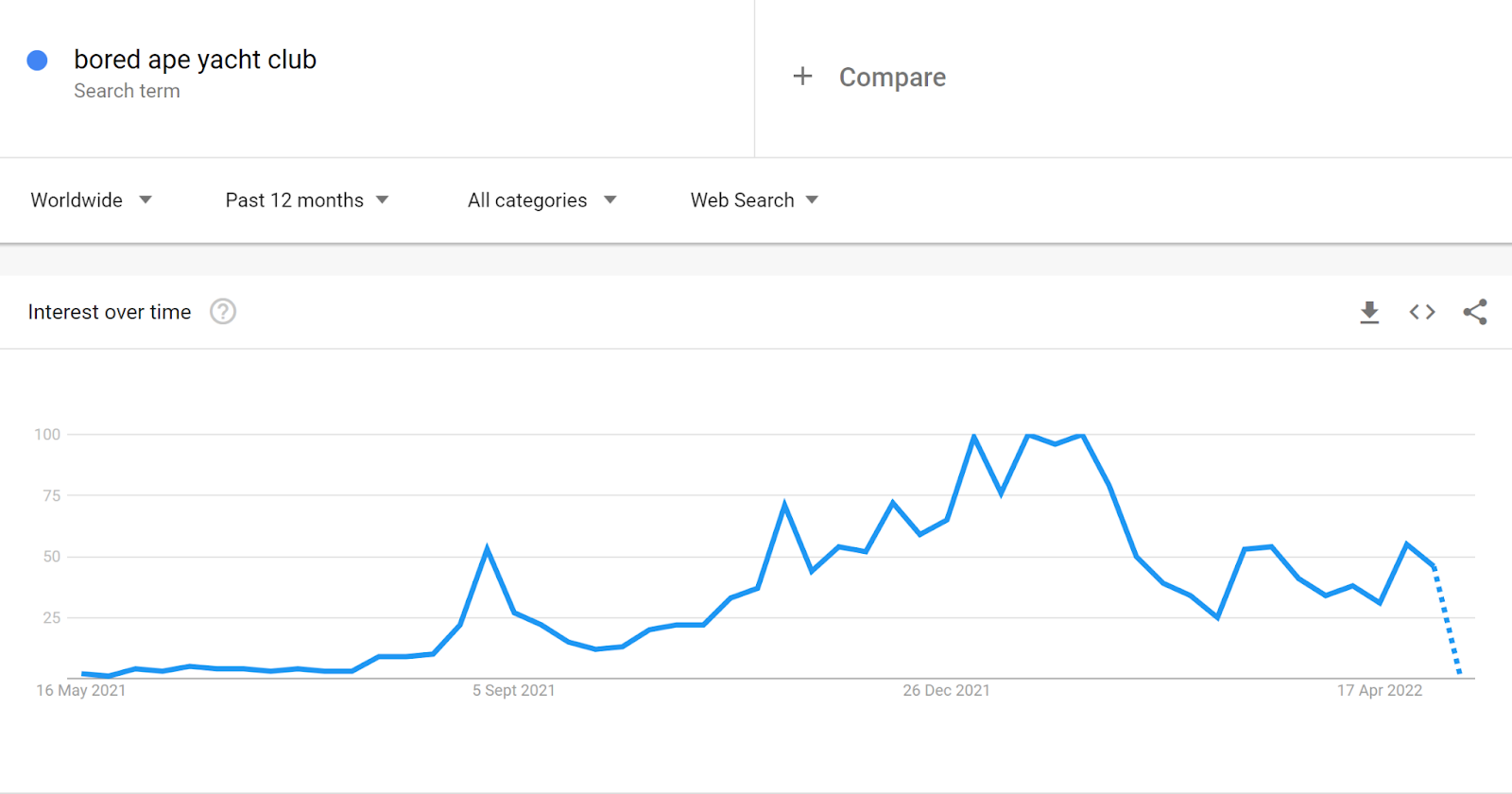

Perhaps no sector has made as much progress as NFTs. As of May 1, $37 billion has been sent to NFT marketplaces so far this year. According to a recent study by Chainalysis as a result, the sector is already well on its way to surpassing the total of 2021, which ended up at USD 41 billion.

If you extrapolate this, you get a projected NFT volume of $ 111 billion in 2022. However, the future of this relatively new industry is still unclear and far from predictable

The extrapolation of this forward indicates a predicted NFT -A volume of 111 billion US dollars in 2022. However, the future of this relatively new industry is still unclear and far from predictable – not to mention the impact of this week’s market turmoil, which could have an impact on future volumes.

The past week has not been easy for the NFT market, as can be clearly seen in the Yuga NFTs, which recorded a massive 31 percent decline, while the market capitalization of the industry has been badly hit with a drop to $ 19.5 billion.

NFT Marketplace Coinbase Disappoints

Chainalysis’ report on the NFT market comes just a few days after the launch of Coinbase’s NFT marketplace. However, so far the activity on the Coinbase marketplace has been extremely disappointing. On the first day of trading, only 150 transactions with a total volume of about $ 75,000 took place on the Coinbase platform. These are not good results for a billion-dollar company like Coinbase, although they will probably work hard to push the market forward.

All in all, the NFT market remains a special phenomenon. Few expected that it would develop into a multi-billion dollar business, but now we have come to this point. However, this does not say anything about the sustainability of the market. Only time can tell to what extent interest in NFTs remains at this level.

Volatility

Looking at the market from a seven-day perspective, most collections have lost more than 50 percent of their value. Apart from the Yuga NFTs housed on Ethereum, more than eight blockchains occupying the top 10 positions have suffered massive losses.

The number of new wallets making purchases has also dropped sharply since this month. However, these steps have not caused analysts to reverse their predictions about the digital art market.

Big spikes in value sent so far this year occurred in February – when OpenSea finally saw significant competition in the form of LooksRare – and also in April, due to the Otherside coin introduced by Yuga Labs, the founders of the Bored Ape Yacht Club.

Bored Ape Yacht Club

Bored Ape Yacht Club was launched only a year ago, but with a minimum price of 99 ETH (still $ 210,000 even after the downturn of the last few days) it has become a showpiece.

If you look at the all-time ranking on OpenSea, the dominance of BAYC becomes clear. While CryptoPunks are still number one in terms of all-time volume, the founder of BAYC, Yuga Labs, owns the IP rights to this collection.

In addition, three of Yuga’s top five projects have been launched. Mutant Ape Yacht Club and the aforementioned Otherside Mint, which were released just last week, have a volume of 250,000 ETH and 390,000 ETH, respectively.

The Otherside project is especially fascinating, as it is an attempt by Yuga Labs to launch its own metaverse, where collectors strive to buy “certificates” in order to “land” in the virtual world.

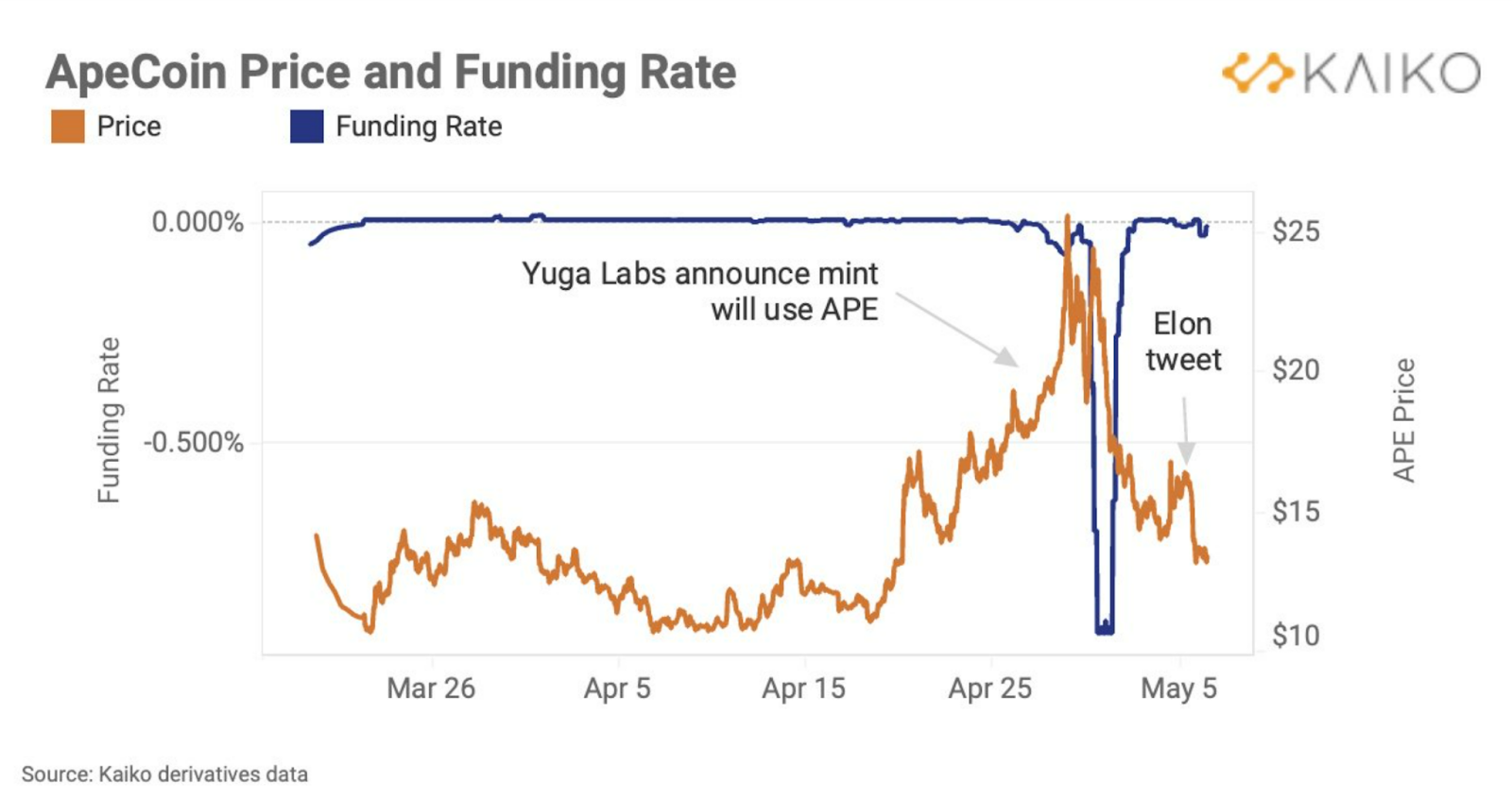

The fascination of this project can be seen in two more ways, apart from the amazing volume shown in the picture above. The first is the gas war that took place on Ethereum during the coin minting, with transaction fees rising to a barely believable four-digit amount. Secondly, ApeCoin’s price action, which was necessary to purchase the NFTs, told a story – it was bid all the way to the top, and then crashed by 50% after minting.

The following graph from Kaiko shows that the funding rates for ApeCoin also turned negative shortly after the announcement that the NFT investors would need the coin to participate. This suggests that traders short-sold the coin, expecting that it would fall after the announcement. Of course, as the orange price line also shows, this turned out to be a very forward-looking step (despite a short recovery thanks to a tweet from Elon Musk).

Moving forward

As discussed above, extrapolating the NFT volume of $ 37 billion for the first four months of the year gives a forecast of $ 111 billion for the year. Whether a direct extrapolation makes sense in view of the stock market crash of the last few days is, of course, another matter.

For comparison, the entire crypto market had a trading volume of $ 14 trillion in 2021, with Bitcoin responsible for $ 9.5 trillion of this figure. This means that the rest of the market totaled $ 4.5 trillion.

Therefore, if NFTs reach $111 billion this year, it means that they would still account for only a relatively small share of 2.5 percent of non-Bitcoin-related trading volume. So maybe there really is more room for growth for NFTs, especially given the extremely short period in which they already exist.

Comments