- Litecoin leads today’s gainers with a 13% jump, renewing interest in large-cap alts.

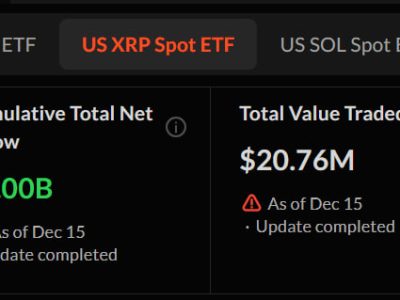

- XRP bulls should defend $3.0 to prevent significant dips.

- Two firms have purchased Solana worth over $23 million.

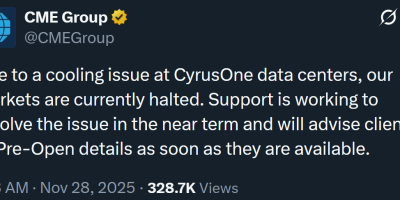

Digital tokens recorded minor price actions on Tuesday as the global cryptocurrency market cap soared 0.15% the past day to $3.73 trillion.

Meanwhile, Litecoin led the gainers with an over 12% gain, sparking interest in large-cap and legacy altcoins.

Ripple’s XRP trades at a crucial juncture as bulls defend the support level at $3.0, while Solana sees institutional traction as two companies purchase SOL worth over $23 million.

Let us find out more!

Litecoin leads the gainers

LTC saw remarkable gains in the past day, surging over 12% from $113 to $128 intraday high.

It trades at $125, with an over 200% uptick in trading volume, signaling robust trader activity.

Short-term technical indicators are flipping bullish.

For instance, the 3H Moving Average Convergence Divergence has crossed above the signal line, with green histograms demonstrating a buyer resurgence.

Also, LTC trades well above the 50- and 100-Exponential Moving Averages on the 3-hour timeframe.

That indicates bullish presence, hinting at upside continuation.

However, the RSI of 71 on the daily chart suggests impending overbought conditions.

Thus, the altcoin could retrace from its current peaks before extending towards the $200 target.

Institutional interest from the likes of Mei Pharma, Litecoin ETF momentum, and predicted altseason positions LTC for impressive rallies in the coming weeks and months.

XRP is at a key support zone

Ripple’s native coin hovers at $3.03 after relatively muted price movements in the previous day.

XRP structure suggests short-term struggles as trading volume remains weak.

However, prevailing sentiments could reinforce the $3.0 foothold.

Emerging speculations suggest that the Ripple vs SEC battle might end soon.

🚨 We’re officially 1 inch closer to the #Ripple-SEC showdown.

📅 August 15 is looming — final verdict incoming.

Buckle up. pic.twitter.com/VwIbgrBS4o

— RippleXity (@RippleXity) August 5, 2025

Also, the remittance company has gained key recognition from the United States authorities.

Technical indicators support XRP’s bullish bias.

The alt consolidated with a descending wedge setup from December to January, while steadying above the 50-d EMA.

The pattern ended with an upside breakout that catalyzed an over 70% increase in January.

XRP is repeating that performance. The digital coin is consolidating inside a descending wedge following substantial price actions.

The pattern sets the stage for a potential surge to $3.75.

Analyst ChartMonkey trusts XRP could top $4 and rally to $6 in the upcoming sessions.

📈LONG: $XRP by MasterAnanda@Ripple XRP Update 🚀Support Confirmed🚀Our next target is not $4, but now $6 & higher! The chart is showing strong momentum & we must adapt to market conditions for continued success. Lets keep aiming higher, traders. #Bitcoin #Crypto #XRPUSDT $XRP pic.twitter.com/sbkRMeat9Z

— Barry | ChartMonkey (@ChartMonkeyBTC) August 4, 2025

However, losing the $3 barrier would delay the projected gains, possibly fueling declines towards the support at $2.80 and $2.48.

Institutions pour $23M into Solana

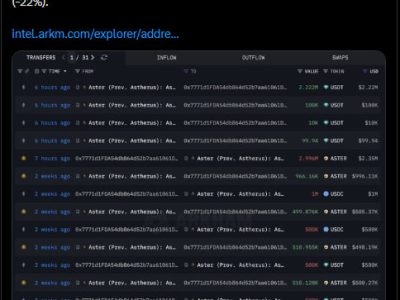

While Litecoin and XRP dominated price charts, institutions loaded up on SOL.

Firstly, crypto infrastructure firm BIT Mining has unveiled its first Solana validator node.

It has bought 27,119 SOL, worth around $4.89 million, to supercharge its Solana treasury.

Commenting on the initiative, BIT Mining Chief Operating Officer Bo Yu said:

This validator launch is a foundational step in operationalizing our Solana strategy. We are not just holding SOL, we are helping power the network. It demonstrates our belief in Solana’s potential and our commitment to building meaningful infrastructure that supports its growth, security, and decentralization.

Secondly, DeFi Development Corp has expanded its Solana holdings with a latest purchase of 110,000 SOL tokens, worth approximately $18.4 million.

That brings its total investments to 1.29 million SOL, valued at over $215 million.

DEFI DEV CORP. $DFDV BUYS 110,466 $SOL FOR $18.4M, NOW HOLDS 1.29M $SOL WORTH ~$209M

— The Wolf Of All Streets (@scottmelker) August 5, 2025

That’s a significant balance since DeFi Dev Corp started its purchase after launching its crypto treasury strategy in April this year, 2025.

SOL trades at $165 after losing 1% in the past 24 hours.

The post Large-cap alts: LTC gains 12%, XRP at key level, SOL lands double institutional buy appeared first on CoinJournal.

Comments