During the downtrend in the crypto market, only a handful of cryptocurrencies have managed to hold their value. These were exclusively stablecoins, and although some of them had lost their value, the majority were able to keep the peg value and provide investors with a much-needed hedge. The sheer amount of USDT being moved by investors on a daily basis is proof that investors are switching to stablecoins to weather the bear market.

On May 12, the volume of Tether-USD transactions on the Ethereum network reached a new all-time high. The data shows that more than $33 billion worth of USDT has been moved across the network. This is significantly more than the 24.5 billion USDT that was implemented on February 4, 2021, the previous all-time high.

However, the motivations for both records were the same: investors moving out of highly volatile digital assets and using an asset that provides a certain level of stability. These investors have not yet wanted to convert their digital assets into fiat currencies, and assets such as USDT or USDC are trusted options to protect against losses in the crypto market.

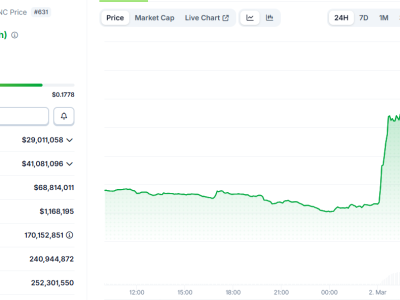

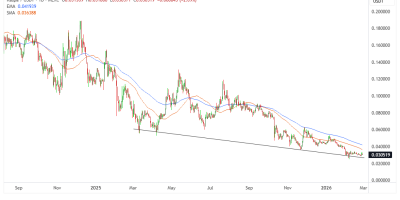

But not every stablecoin is completely trustworthy, as the crash of Terra UST shows. The supposed stablecoin, which is linked to Bitcoin, should also keep the level of $1, but due to the market turmoil, Terra UST collapsed and plunged to $0.15. This bloodbath led to the fact that the Terra cryptocurrency called Luna became worthless over the past few days.

Comments