- Dogecoin whales have cut holdings as market sentiment turns risk-off.

- Project Sakura aims to shift DOGE to proof-of-stake.

- DOGE is trading in a triangle pattern with breakout potential on the horizon.

Dogecoin (DOGE), the world’s largest meme coin, has faced growing selling pressure in recent days, although signs of resilience remain.

With major investors scaling back exposure and a bold new protocol proposal in the works, the future path of DOGE is being shaped in real time.

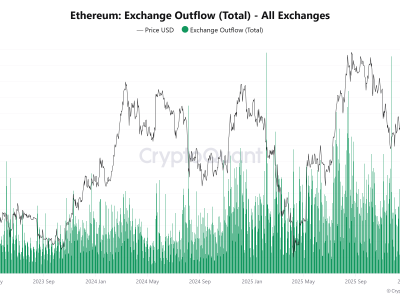

Whales trim holdings as sentiment weakens

Large holders of DOGE, often referred to as whales, have steadily reduced their positions over the past few weeks.

According to on-chain data, addresses holding between 10 million and 100 million coins now account for just over 16% of the total supply, down from nearly 17% in July.

This retreat reflects a broader risk-off mood across crypto markets, where investors are choosing to de-risk amid a wave of uncertainty.

At the same time, the futures market is also signalling caution.

Open interest, which measures the total value of outstanding contracts, has fallen sharply from a July peak of $5.35 billion to around $3.54 billion.

The drop suggests traders are less willing to bet aggressively on short-term price gains, dampening the chances of an immediate recovery.

Activity on the Dogecoin network slows

On-chain data from Glassnode shows that daily active addresses have collapsed from over half a million in June to fewer than 50,000 in late August.

The steep decline in user activity points to fading demand for DOGE as a medium of exchange, and it has become a drag on price performance.

Despite the pullback, Dogecoin has managed to hold a key technical level near $0.21.

Analysts say this zone, backed by the 100-day and 200-day exponential moving averages, has become an important line of defence for bulls.

If broken, the next significant support levels lie at $0.18 and $0.16.

Project Sakura promises a shake-up

Amid these pressures, the Dogecoin Foundation has revealed Project Sakura, a protocol test that could reshape the network.

Director Timothy Stebbing described the initiative as a move to transition Dogecoin from its proof-of-work system to proof-of-stake.

The shift, he argues, would make the network more secure against 51% attacks and align with Dogecoin’s long-term ambition of becoming a true global currency.

The idea of staking has divided the community, with some viewing it as a necessary innovation while others see it as a departure from the coin’s original ethos.

If implemented, the protocol change could attract institutional support and redefine Dogecoin’s role beyond its meme coin label.

Technical picture points to an explosive move

On the charts, DOGE is trading inside a symmetrical triangle pattern near $0.22 as highlighted by crypto analyst Ali Martinez.

Dogecoin $DOGE: One last dip before the breakout! pic.twitter.com/DQh70ilOas

— Ali (@ali_charts) August 25, 2025

Resistance looms at $0.25, while the base of the triangle rests near $0.165.

This structure, which reflects weeks of consolidation, often precedes sharp moves once the price breaks through either side.

Technically speaking, consolidation rarely lasts long, meaning a breakout may be closer than many expect.

If Dogecoin holds support and breaks upward, it could target $0.44 in the near term, representing a gain of about 170%.

A failure to defend $0.21, however, would leave the door open to a slide toward the $0.18–$0.16 zone.

The post Dogecoin at a crossroads: whales exit, support holds, breakout looms appeared first on CoinJournal.

Comments