- BlackRock’s iShares Bitcoin Trust (IBIT) saw $292.5 million exit the fund on Monday.

- Spot Ethereum ETFs also faced heavy outflows on Monday.

- The selling pressure came as Bitcoin extended its retreat from the July 14 all-time high.

US-listed spot Bitcoin and Ethereum ETFs continued to see outflows on Monday, extending a recent trend of investor pullback as digital assets slid from their recent highs.

Monday marked the third consecutive trading session of net outflows across US-listed spot Bitcoin funds.

Bitcoin ETFs log consecutive outflows

BlackRock’s iShares Bitcoin Trust (IBIT) saw $292.5 million exit the fund on Monday, the largest single-day outflow it has recorded since May.

The fund had already broken its 37-day inflow streak with a minor outflow on Friday.

The selling pressure came as Bitcoin extended its retreat from the July 14 all-time high.

The token dropped 8.5% over the weekend, bottoming out at $112,300 on Sunday before partially recovering to $115,000 by late Monday trading.

Despite the recent setback, BlackRock’s IBIT still logged a net inflow of $5.2 billion in July, equivalent to 9% of the fund’s total inflows since its launch in January 2024.

Other Bitcoin ETFs also saw subdued activity. Fidelity’s Wise Origin Bitcoin Fund (FBTC) posted an outflow of approximately $40 million, while the Grayscale Bitcoin Trust (GBTC) lost $10 million.

Bitwise’s Bitcoin ETF (BITB) was the only product to record an inflow on Monday, attracting $18.7 million.

All other US-listed Bitcoin ETFs recorded no flows.

The overall outflow on Monday was significantly milder compared to Friday’s sharp exit of $812 million, suggesting that pressure may be easing as Bitcoin finds support near current levels.

Volatility cools since ETF launch

Commenting on the recent price behaviour, Bloomberg ETF analyst Eric Balchunas noted on Monday that Bitcoin volatility has declined notably since the approval of spot Bitcoin ETFs earlier this year.

He highlighted that the 90-day rolling volatility for BlackRock’s IBIT has dropped below 40, down from levels above 60 at the time of the ETF’s launch.

VOL KILLER: Since the launch of the ETFs the volatility on bitcoin has plumetted. The 90-day rolling vol is below 40 for the first time- it was over 60 when the ETFs launched. I threw in $GLD for perspective. Less than 2x gold, used to be over 3x. pic.twitter.com/r1S7WztJ4i

— Eric Balchunas (@EricBalchunas) August 4, 2025

Balchunas previously said that reduced volatility and the absence of sharp drawdowns have helped Bitcoin appeal to larger institutional investors, potentially aiding its broader adoption as a currency.

Ethereum ETFs see record one-day outflow

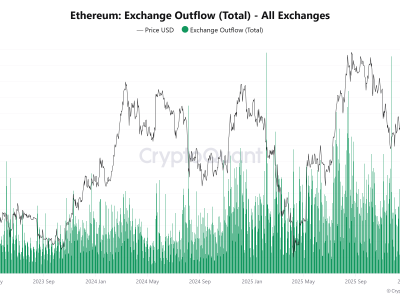

Spot Ethereum ETFs also faced heavy outflows on Monday, with a total of $465.1 million withdrawn across multiple funds.

This was the highest single-day net outflow since these products launched.

BlackRock’s spot Ether fund (ETHA) led the retreat, with $375 million in outflows.

Fidelity’s FETH, Grayscale’s ETHE, and the Grayscale Ethereum Mini Trust also experienced redemptions.

The Monday exodus followed a period of strong investor interest in Ethereum ETFs.

Inflows had totaled $2.2 billion in the second week of July, $1.9 billion in the third week, and $154.3 million last week, according to data from SoSoValue.

The post Bitcoin and Ethereum ETFs see continued outflows as market pulls back appeared first on CoinJournal.

Comments