- Prenetics halts new Bitcoin purchases after recent crypto market volatility.

- The company is prioritising the growth of its IM8 supplements brand.

- Prenetics currently holds 510 BTC and over $70 million in cash reserves.

Prenetics Global, a consumer health and supplements company backed by football icon David Beckham, has reversed its short-lived plan to build a Bitcoin treasury, opting instead to focus its capital on expanding its flagship nutrition brand, IM8.

In a statement issued on Tuesday, the Nasdaq-listed firm confirmed that it will no longer pursue additional Bitcoin purchases, signalling a shift away from digital assets amid volatile market conditions.

The company’s management stated that the redirection of resources is aimed at accelerating growth in IM8, which the company describes as one of the fastest-scaling supplement brands in the global wellness sector.

Notably, the decision comes less than three months after the company raised $48 million in fresh equity financing that was raised for cryptocurrency accumulation as a strategic objective.

Strategic pivot after crypto market volatility

When Prenetics announced its equity raise in October, Bitcoin was trading near historic highs, hovering above $110,000.

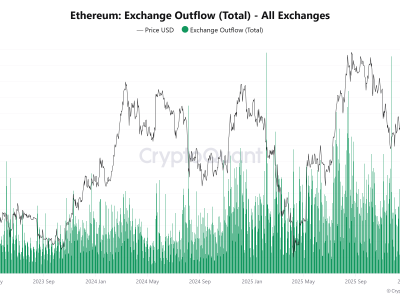

Since then, prices have dropped significantly, reflecting broader instability across digital asset markets driven by tightening financial conditions, regulatory uncertainty, and reduced institutional risk appetite.

As of this week, Bitcoin has fallen to the high-$80,000 range, underscoring the challenges companies face when managing crypto-heavy balance sheets.

Although the fundraising round was intended to support both Bitcoin accumulation and consumer brand expansion, Prenetics’ leadership now views its health and wellness business as a clearer path to long-term value creation.

The Chief Executive Officer and co-founder, Danny Yeung, said the board unanimously agreed that focusing on IM8 represents a rare growth opportunity that outweighs the potential benefits of further crypto exposure.

However, the company plans to hold on to its crypto assets despite halting new purchases.

Prenetics disclosed that it still holds approximately 510 Bitcoin alongside more than $70 million in cash and cash equivalents, providing flexibility while it reassesses capital allocation priorities.

Part of a broader corporate reassessment of crypto treasuries

Prenetics’ move mirrors a growing trend among publicly listed companies that experimented with cryptocurrency treasury strategies during bullish market cycles.

As crypto prices pull back, several firms are scaling back or abandoning aggressive accumulation plans in favour of more predictable uses of capital.

Earlier this month, Ethereum-focused treasury firm ETHZilla, backed by prominent technology investors like Peter Thiel, announced a pivot away from holding ether toward real-world asset tokenisation initiatives.

Other companies across sectors have similarly turned to share buybacks, debt reduction, or reinvestment in core operations as safer ways to support shareholder value during uncertain market conditions.

Investors in Prenetics’ October funding round included major crypto industry names such as Kraken, Exodus, and GPTX, alongside traditional investment firms.

While their participation highlighted confidence in the company’s innovation strategy, Prenetics’ latest announcement reflects a more cautious and pragmatic stance toward digital assets.

The post David Beckham–backed Prenetics abandons Bitcoin strategy to focus on core health business appeared first on CoinJournal.

Comments