- WLFI token launches on Binance at $0.30+, valuing it over $30B FDV.

- Trump family’s WLFI stake worth ~$6B; most insider tokens remain locked.

- 25% of supply unlocked at launch; early buyers see up to 20× paper gains.

The governance token of World Liberty Financial (WLFI), a crypto project backed by US President Donald Trump and his family, began trading on Monday in what is emerging as one of the year’s most closely watched token launches.

The debut has given WLFI a fully diluted valuation of more than $30 billion, with early activity suggesting strong investor interest and sharp paper gains for initial backers.

Trading debut and exchange listings

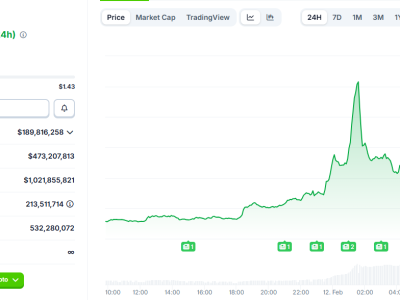

WLFI launched on centralized exchanges at 1 p.m. UTC on September 1, with Binance announcing trading pairs in WLFI/USDT and WLFI/USDC.

Other major venues, including Upbit and Gate, also confirmed support.

Shortly after its launch, the token was changing hands at above $0.30, implying a $30–33 billion valuation based on its 100 billion total supply.

Of that supply, 24.67 billion WLFI — roughly 25% — entered circulation at launch.

The float includes 10 billion tokens allocated to World Liberty Financial, Inc., seven billion designated for Alt5 Sigma Corporation’s treasury strategy, and 2.8 billion set aside for liquidity and marketing.

Additionally, about four billion tokens became claimable by early investors through the project’s Lockbox mechanism, representing 20% of the WLFI bought during $0.015 and $0.05 funding rounds.

The remaining allocation for public sale participants remains locked.

Trump family stakes and investor limits

The Trump family, including Donald Trump Jr. and Eric Trump, hold significant WLFI allocations through their involvement in World Liberty Financial.

According to estimates by The Wall Street Journal, the family’s WLFI holdings have a paper value of about $6 billion, with the former president personally holding roughly two-thirds of that amount.

Despite these large positions, not all insiders are able to sell immediately.

Founders are subject to restrictions, while early investors outside the founding circle can liquidate only up to 20% of their allocations at launch.

The majority of tokens remain subject to lock-ups or vesting schedules, including 19.96 billion reserved for the Treasury, 33.51 billion for the team, 16 billion from the public sale, and 5.8 billion for strategic partners.

Analysts suggest much of the early investor enthusiasm has been driven by the association with Trump, making WLFI’s initial trading performance an early test of the brand’s pull within digital assets.

Positioning in DeFi and stablecoin expansion

World Liberty Financial launched in 2024 as a decentralized finance platform designed to connect traditional financial products with blockchain infrastructure.

The protocol operates primarily on Ethereum and integrates with Aave V3 for lending and borrowing services, while maintaining reserves and custody arrangements.

WLFI functions as the project’s governance token, allowing holders to vote on parameters, incentive programs, and growth initiatives.

Initially non-transferable, the asset was approved for open trading in July.

The launch also comes alongside World Liberty’s expansion of USD1, its stablecoin pegged to the US dollar.

Recently rolled out on Solana in addition to Ethereum, BNB Chain, and Tron, USD1 has grown into the sixth-largest stablecoin with a $2.6 billion market capitalization.

Derivatives activity surged ahead of WLFI’s debut, with perpetuals volume rising about 400% on the eve of listing, according to The Block.

If the token maintains its current price levels, its valuation would place it among established names like Sui, Dogecoin, and Tron. Early buyers stand to see returns of up to 20 times their initial investment.

The post Trump-backed WLFI token begins trading with $30B valuation appeared first on CoinJournal.

Comments